Article

How Are Technology Investment Decisions Impacted By Bonds Yields, Interest Rates and Exchange Rates?

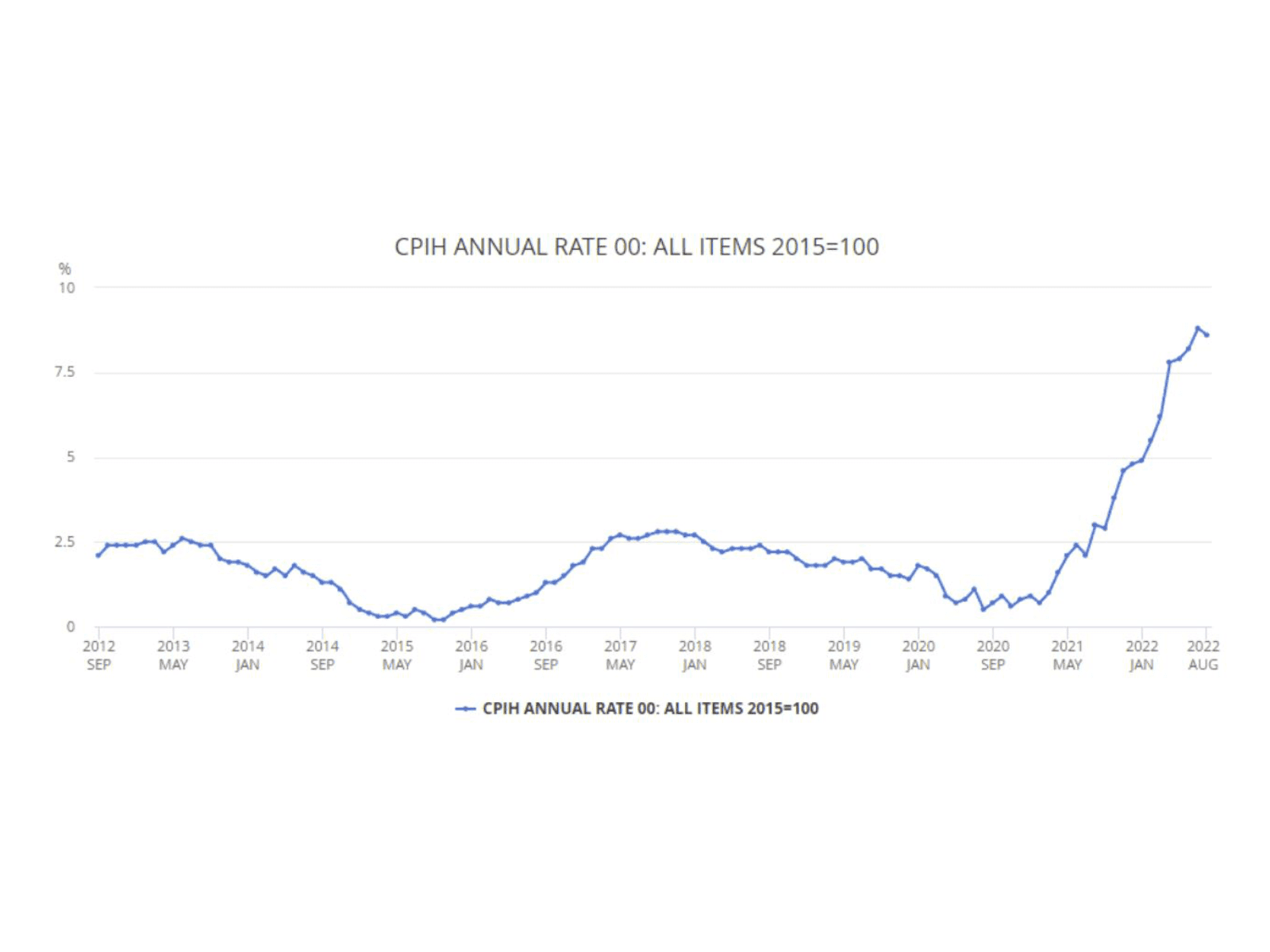

In late September 2022 the UK financial markets had settled into a rhythm of rising bond yields, predicating a rise in interest rates, while Sterling was losing value against other major currencies, especially the Dollar. The scene was set in 2021 as countries globally saw inflation increase as economic activity restarted following the Covid19 pandemic. In the UK inflation was at 0.9% in Jan 2021, but finished the year at 4.8%.

Context

There were multiple drivers behind this rise in inflation, but some of the most notable were transport fuel, wholesale energy prices and restaurants and hotels. As lockdowns were lifted demand for energy and fuel increased as businesses reopened and people began to travel once again. Global energy supply took longer to return to pre-Covid output levels causing prices of energy and fuel to increase.

Restaurants and hotels had to create new, Covid safe spaces for their customers as well as seeing input costs rise. Having suffered badly during lockdowns these cost increases inevitably had to be passed on to customers, adding inflationary pressure.

In normal times a persistent rise in inflation is typically met with increasing interest rates and/or taxes to slow down spending in the economy to reduce inflationary pressure. However, During Covid the UK government provided wide scale support to individuals via initiatives such as the furlough scheme and businesses were supported via the Bank of England's quantitative easing programme, which keeps the cost of borrowing low.

In 2021 policy makers expected inflation to be transitory, subsiding as producers restored supply and global freight shipping returned to normal. This belief allowed them to keep expansionary policies in place which meant inflation was running at 4.9% in January 2022.

2022 brought new external shocks which added to inflationary pressures and seemingly increased the likelihood of them becoming longer lasting. Most notably Russia invaded Ukraine and the economic sanctions package imposed by the West resulted in major disruption to the wholesale natural gas market, causing prices to increase sharply. This increase in energy prices has far reaching implications, ultimately increasing input costs for almost all businesses and households.

In July 2022 UK inflation stood at 8.8%. However, the inflationary pressures were not a local issue, they were global as can be seen by the US experiencing comparative inflation at 8.5% in July 2022.

The Dollar came into 2022 increasing in strength versus Sterling, likely due to factors such as greater supply chain disruption and less energy independence in the UK versus the US. That Dollar strength was reinforced through 2022 by more aggressive monetary tightening in the US.

| Month | Bank of England Base Rate | Federal Funds Rate |

|---|---|---|

| January 2022 | 0.25% | 0.25% |

| February 2022 | 0.50% | 0.25% |

| March 2022 | 0.75% | 0.50% |

| April 2022 | 0.75% | 0.50% |

| May 2022 | 1.00% | 1.00% |

| June 2022 | 1.25% | 1.75% |

| July 2022 | 1.25% | 2.50% |

| August 2022 | 1.75% | 2.50% |

| September 2022 | 2.25% | 3.25% |

The Bank of England was the earliest G7 country to begin raising interest rates post Covid, raising interest rates to 0.25% in December 2021. The Federal Reserve waited until March 2022 before making a quarter point rise, but quickly became more aggressive as financial markets began to anticipate larger interest rate rises in the medium term due to the absence of aggressive interest rate rises in the near term. This medium term anticipation of higher interest rates caused repricing in financial markets such as equity and treasury bond markets, with share prices falling rapidly and bond yields increasing as their prices also fell.

In response to this market reaction the Federal Reserve became more aggressive, making 3 0.75% rises between June to September, at which point interest rates in the UK stood at 2.25% versus 3.25% in the US.

This interest rate differential encourages selling of Sterling and buying of Dollars, which causes Sterling to fall in value versus the Dollar. Since much of global trade is denominated in Dollars, the practical impact of this is to drive UK inflation higher, since imported goods become more expensive, since Sterling is worth less. Or in other words, in January 2022 £1 would allow you to purchase something worth $1.36, but in September 2022 £1 would only allow you to purchase something worth $1.03 at the lowest point.

The third component of these market dynamics is treasury bond yields, or gilts, as they are known in the UK. Treasury bonds, or gilts, are issued, or sold, by governments. They promise the buyer a fixed payment, known as the coupon, along with a guarantee of repaying the original purchase price on expiry of the gilt. After the initial purchase gilts are traded on a secondary market, much like shares, meaning their value can fluctuate, even though their fixed payment remains the same.

Dividing the coupon by the market price of the gilt gives the current yield, or rate of income, that the gilt is paying. When the price of gilts goes up, the yield, calculated by dividing the coupon by the market price of the gilt, goes down and vice versa. These yields act as an advertisement for the rate of interest the market will demand in order to purchase more bonds from the government. Not only do falling gilt prices and the corresponding increasing gilt yields, imply the government must pay more interest on its future borrowings, they in turn raise the cost of borrowing for all businesses and households.

The Impact of Inflation Expectations on Technology Companies

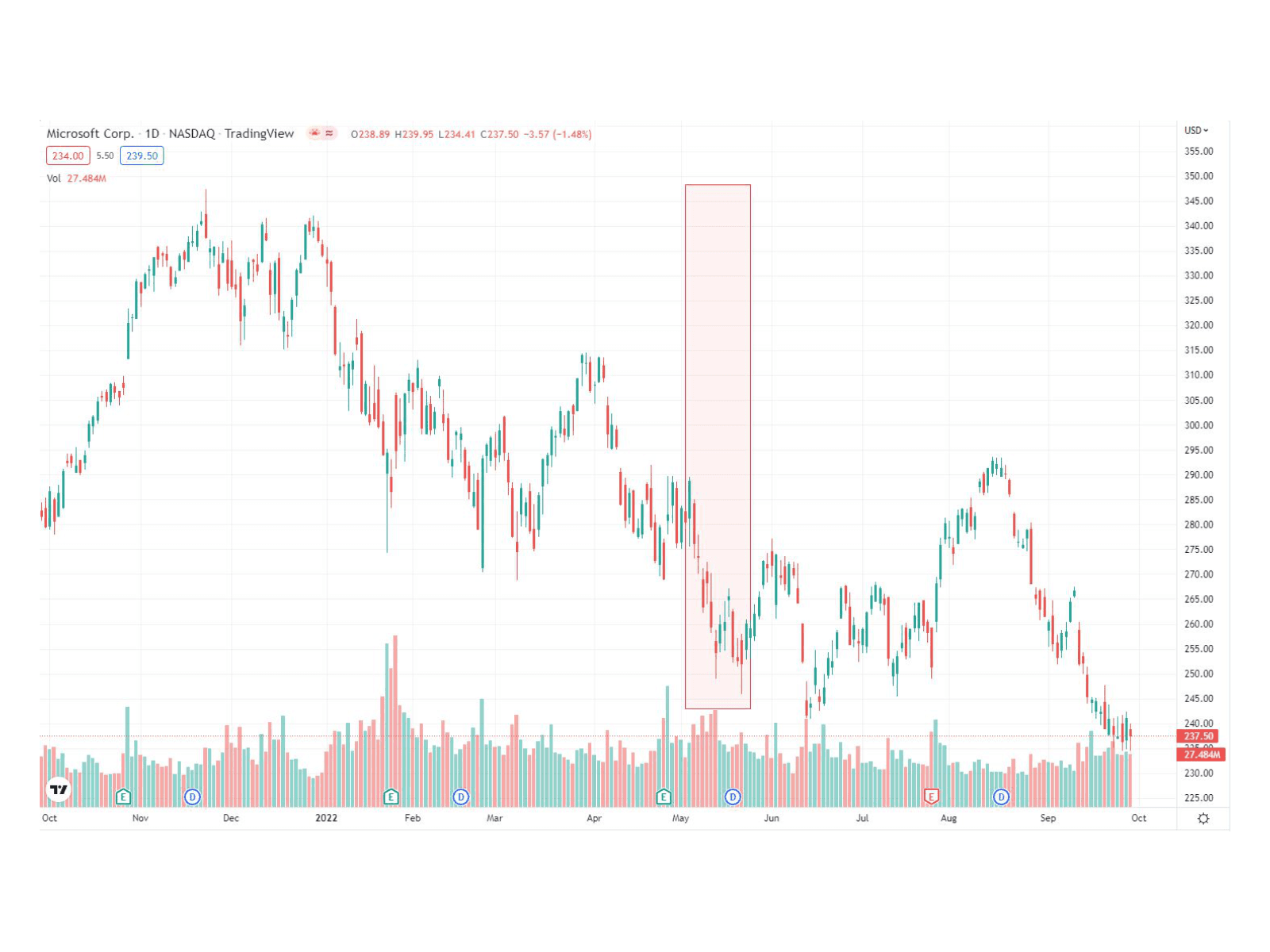

With inflation expectations becoming entrenched in the early part of 2022, share prices in general began to fall. By May 2022 financial markets were expecting the Federal Reserve to raise interest rates to halt the rise in inflation. The Microsoft share price chart below shows that in response to the Federal Reserve raising interest rates by 0.50% on May 5th 2022, there was mass selling with the share price falling from $284 to $254.

The reason for this fall in the share price was that participants in the financial markets felt that the Fed did not raise interest rates enough. They conclude that the impact would be inflation increasing further and that this would ultimately require the Fed to raise interest rates higher in the future, which would increase the chances of the economy falling into a recession. A recession would be bad for earnings and that would reduce the value of the company.

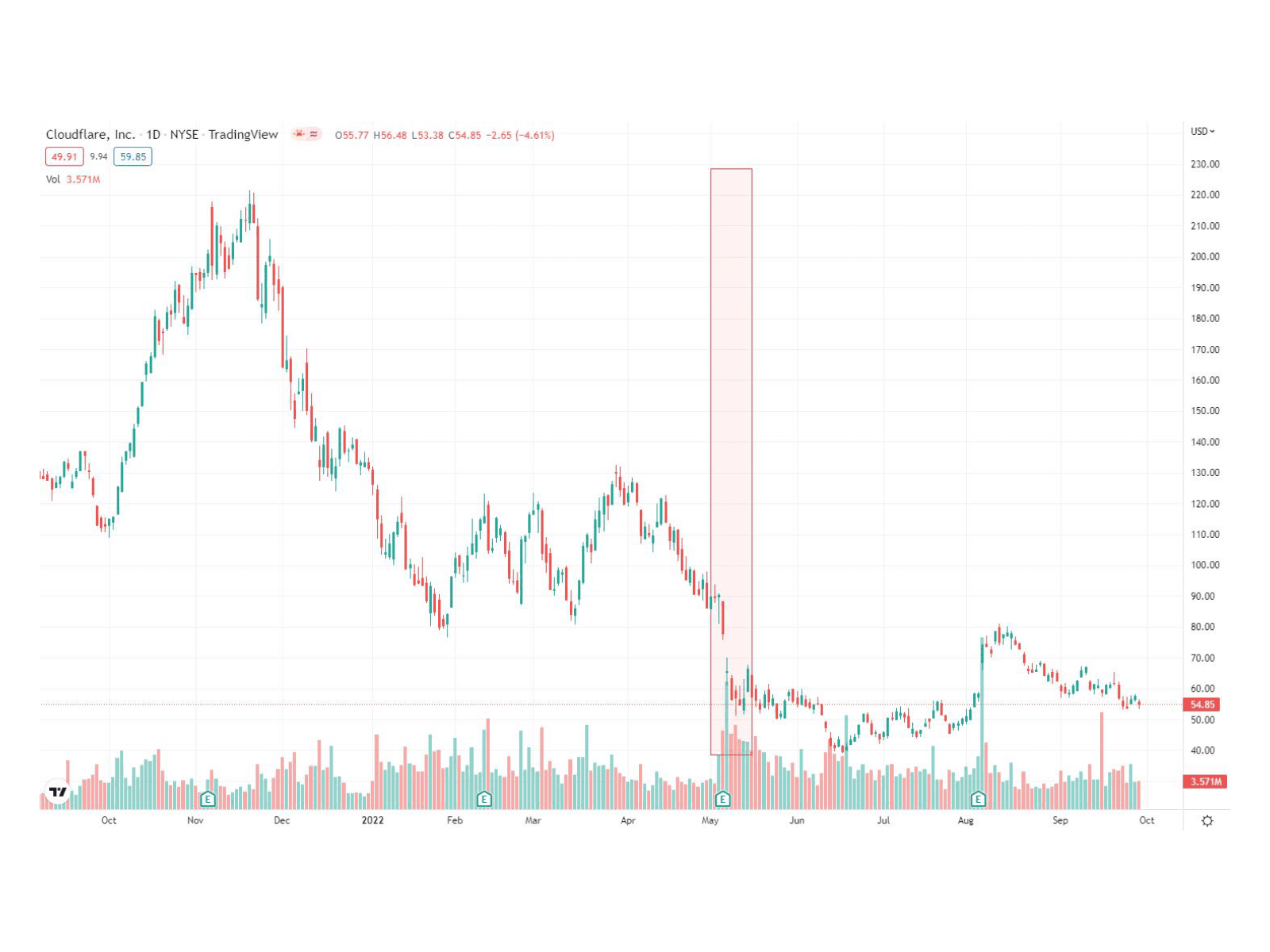

Microsoft is one of the most stable technology companies in the world. Cloudflare, a web performance and security company, is a much younger company and has been growing rapidly. The May 5th sell off impacted Cloudflare more severely than Microsoft with their share price dropping from $88 to $53.

While Microsoft fell by 11%, Cloudflare fell by 40% suggesting that the value of Cloudflare and therefore its share price is more sensitive to inflation and interest rate expectations. The reason for this is that companies are valued based on expectations of their future earnings. Fast growing technology companies are expected to generate significantly greater earnings in the future than they do today and those companies are valued based on expected earnings a long way into the future.

When valuing a company, expectations of their future earnings are used to calculate their NPV, or net present value. The NPV is not simply a summation of future earnings, because the value of those earnings is affected by interest rates. While future earnings of a company are uncertain, interest rates offer a return that is certain. Therefore, when interest rates are high there will be less appetite to speculate on the uncertain future earnings of a company.

NPV reflects this fact by using interest rates to discount those future earnings. The more a company relies on future earnings to set its current day share price, the more sensitive it will be to interest rate rises because the impact of discounting future earnings is amplified.

Managing A Portfolio of Technology Investment Projects

A responsibility of a CTO, or chief technology officer, is to manage a portfolio of technology investment projects, such as development of new software applications, using technology to automate processes, adopting artificial intelligence to solve business problems and transforming towards being a data driven business.

These projects can be multi million pound projects running across several years and they should be assessed using the NPV of the project. Whether the project is revenue generating or efficiency improving, an estimation of its future earnings should be made. It is also necessary to assess whether there will be a one off earning from the project, perhaps a sale of intellectual property, or multiple earnings, such as developing software that will automate a process creating efficiencies every day for the foreseeable future.

For example, software could be developed to automate a process that will generate £5,000 of efficiency savings per year at a development cost of £50,000. This example will begin by calculating the project NPV using 2% as the discount rate, a low rate that has been readily available since the global financial crash in 2008:

| NPV of efficiency gain | ||

|---|---|---|

| Year 1 efficiency gain | £12,000 | £11,764 |

| Year 2 efficiency gain | £12,000 | £11,534 |

| Year 3 efficiency gain | £12,000 | £11,307 |

| Year 4 efficiency gain | £12,000 | £11,086 |

| Year 5 efficiency gain | £12,000 | £10,868 |

NPV = £11,764 + £11,534 + £11,307 + £11,086 + £10,868 - £50,000 NPV = £6,561

This project has a positive NPV so should be considered a viable project. However, higher interest rates can change the viability of a project. During September 2022 the gilt yield curve indicated that interest rates could rise as high as 6% in 2023.

| NPV of efficiency gain | ||

|---|---|---|

| Year 1 efficiency gain | £12,000 | £11,320 |

| Year 2 efficiency gain | £12,000 | £10,679 |

| Year 3 efficiency gain | £12,000 | £10,075 |

| Year 4 efficiency gain | £12,000 | £9,505 |

| Year 5 efficiency gain | £12,000 | £8,967 |

NPV = £11,320 + £10,679 + £10,075 + £9,505 + £8,967 - £50,000 NPV = £548

The higher interest has made this project look much less attractive. It also illustrates the significance of the time value of money or TVM, with the NPV of the year 5 gain having an NPV that is £2,353 lower than the year 1 efficiency gain, even though they are the same absolute amount. The TVM teaches us that receiving £1 today is better than receiving £1 in the future. This is because money received today can be invested today, earning a return and its value is not being eroded by inflation.

Given the importance of TVM our project viability must also consider when the efficiency gains are realised.

| NPV of efficiency gain | ||

|---|---|---|

| Year 1 efficiency gain | £0 | £0 |

| Year 2 efficiency gain | £15,000 | £13,349 |

| Year 3 efficiency gain | £15,000 | £12,594 |

| Year 4 efficiency gain | £15,000 | £11,881 |

| Year 5 efficiency gain | £15,000 | £11,208 |

NPV = £13,349 + £12,594 + £11,881 + £11,208 - £50,000 NPV = -£965

Even though this project will return the same absolute efficiency gain over the same period, because the gains do not start to be realised until the second period the project now has a negative NPV, indicating it should not be taken forward.

Often technology investment projects are intended to be transformative and therefore it is unlikely that they will exhibit an NPV near to zero. That said, it is quite possible to define a technology project that is both transformative and a waste of money, and this possibility must be examined. However, the NPV is also useful for prioritising a portfolio of potential technology projects all having a positive NPV. As has been shown, projects that return value sooner could be more beneficial even if they ultimately return less absolute value.

Read more about estimating the value of digital transformations.

Exchange Rate Risk When Hiring Abroad For Technology Projects

There has been an increasing trend in the UK to hire software developers from abroad to take advantage of lower wages in countries with a lower cost of living. However, this offshoring introduces exchange rate risk. Wage inflation for the development team is no longer solely driven by local factors. Instead somebody must bear the risk of exchange rate movements.

With the US dollar being the world's reserve currency it is often used in offshoring contracts. For UK companies offshoring to teams that sell their services in dollars, the fall in the value of Sterling versus Dollars has caused a problem. In January 2022 £1 was worth $1.37, by 26th September 2022 £1 was worth $1.03 representing roughly a 25% fall in the value of Sterling.

At these extremes a $20,000/month development team has increased in price to the UK company from £14,598 to £19,417. One option could be to price contracts in the currency of the buyer, however this is not a risk free option. Rather it shifts risk to the supplier, with their monthly payments falling from $20,000 to $15,035.

What Next?

If your business could benefit from strategic technology insights, join the SME Growth Cohort.

It is a group of highly motivated small and medium sized business owners/execs seeking growth acceleration through modern technology adoption, they just don't have the tech expertise internally to make it happen., they just don't have the tech expertise internally to make it happen.

We meet virtually once a week for a live Q&A and discussion around trending topics such as AI adoption, outsourced development, business exit planning.

You can ask your own questions or just listen in to soak up ideas and experiences.

I have worked with Graham since 2016 in what started as a technology advisor role. Our team quickly learned that he brought invaluable business acumen. Whether it has been technical mentorship, establishing processes, hiring freelancers, adopting AI or exploring the intersection of business and technology, Graham's input has been a critical part of unlocking our growth. Joining his Growth Cohort would be time and money well spent.

-- Tim Waxenfelter, Endurance Learning

You can also join our newsletter for tech strategy, playbooks, frameworks, deep dives and peer experiences.